Comets Help Tax Filers Get Real Savings in Virtual Program

By: Brittany Magelssen | April 14, 2021

For many taxpayers this year, filing taxes may be especially challenging. Economic relief checks, unemployment payments and working remotely are all issues that may impact filing.

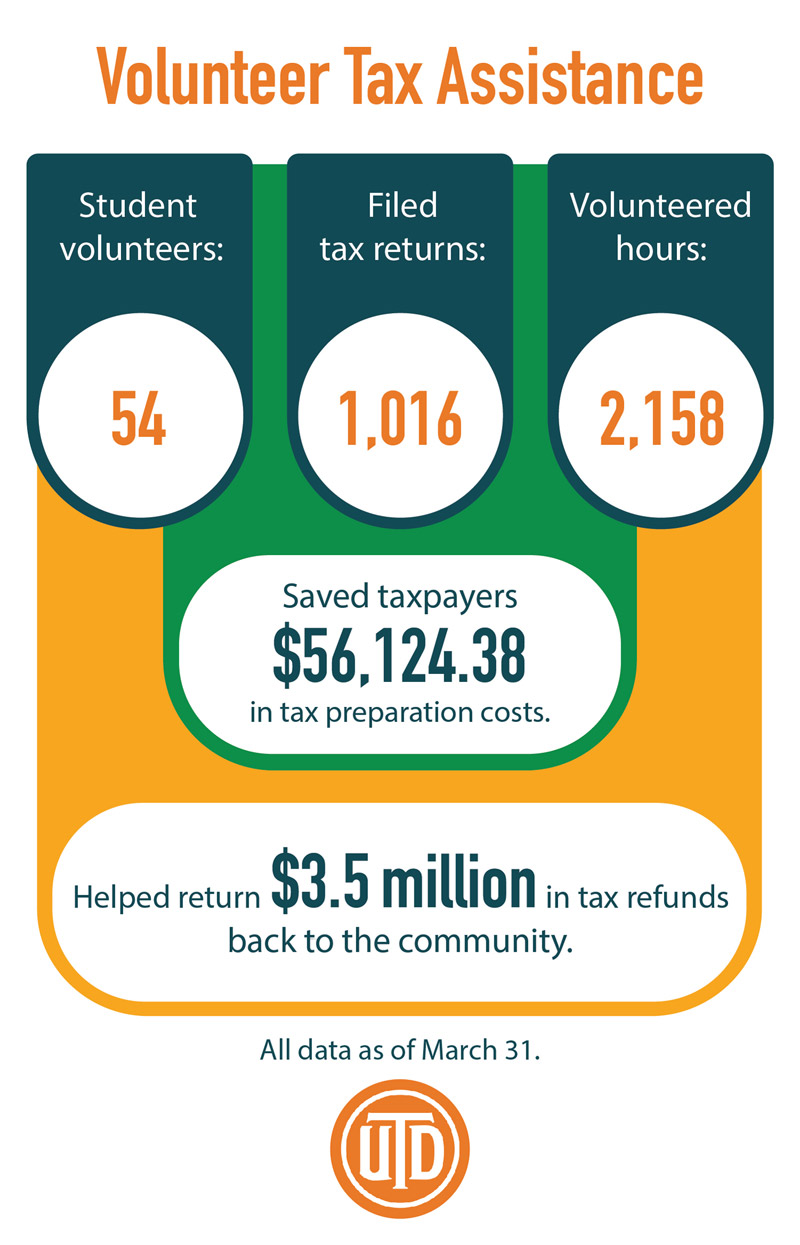

More than 50 students from The University of Texas at Dallas saw this as a call to help the community, and this year, they are doing so virtually.

UT Dallas’ participation in the Volunteer Income Tax Assistance (VITA) program is designed to provide students an opportunity to expand and apply their tax compliance skills in a community service environment and gain a greater understanding of the workings of a public tax practice, said Kathy Zolton, associate professor of practice of accounting in the Naveen Jindal School of Management and VITA program coordinator for the University.

The Jindal School’s accounting department has partnered with Foundation Communities for more than 10 years on VITA, which provides free tax-return preparation to low- to moderate-income individuals and families who make less than $58,000 per year.

In light of the COVID-19 pandemic, Foundation Communities is offering a fully virtual tax preparation service for their clients this year.

Zolton said between 50 and 150 UT Dallas students volunteer with the program each year, and in recent years most of the volunteers have been undergraduate accounting students.

“This program has been a popular method for graduate students to receive hands-on experience in preparing taxes and customer service,” said Zolton, who recruits students to volunteer and monitors their progress throughout tax-filing season. “For the undergraduate students, it has been a highly sought-after opportunity to meet the Jindal School’s 100-hour community service requirement.”

Dividends in Gratitude

Hans Baldivas, an accounting senior, is volunteering with VITA for the third time. This year, she misses the face-to-face interaction with her clients. It’s her favorite aspect of the program: seeing the big smiles and gratitude from families.

In a typical year, volunteers meet clients in person, help them fill out paperwork, input their data and explain their taxable income, deductions and if they will receive a refund or owe money. Baldivas would work the weeknight shifts and often spend all day Saturdays volunteering.

She remembers a dad shaking her hand repeatedly and thanking her for her help. After using the free service and learning of a refund, he could now afford to buy jackets and food for his children.

“Volunteering with VITA is always rewarding, but what we’re doing seems even more important now, during the COVID-19 pandemic and after the February winter storm. … It always feels good when you see the smile and gratitude from families who are having a hard time, and it seems like you helped them lift a big worry off their shoulders.”

Hans Baldivas, an accounting senior at UT Dallas

“Volunteering with VITA is always rewarding, but what we’re doing seems even more important now, during the COVID-19 pandemic and after the February winter storm,” Baldivas said. “There are several changes with the stimulus checks, and many people have lost their jobs. It always feels good when you see the smile and gratitude from families who are having a hard time, and it seems like you helped them lift a big worry off their shoulders.”

For Baldivas, who aims to join a public accounting firm and work within audit practice, volunteering has boosted her skills in accounting and communication and her confidence in interacting with others.

As a way to stay connected this year, she said, some volunteers touch base at the end of a shift to see how many returns everyone completed. They also review their previous returns and see how many were accepted by the Internal Revenue Service.

“It’s just a mini-competition for us to ensure that we are doing our work correctly and providing the best quality and help with our time volunteering,” she said.

Passion To Help Others

Ronnie Daniels has worked with Foundation Communities for more than 11 years and spearheads the Dallas metropolitan branch, Dallas Community Tax Centers. As the largest VITA organization in the Dallas-Fort Worth area, the center prepares thousands of returns each year, he said.

When locations abruptly shut down in mid-March 2020 due to the pandemic, the organization had to reexamine ways to continue assisting taxpayers, Daniels said, which resulted in programs such as Virtual VITA.

“Dallas Community Tax Centers would not be able to prepare the number of returns it does without the help of our UT Dallas student volunteers,” he said. “More than 20% of our volunteers come from the University. With COVID-19, we had to implement ways to still provide quality tax preparation service to our taxpayers and ensure the safety of our volunteers.”

Jasmine Cook BS’20 is volunteering for the third time as she prepares to begin graduate school.

She said although she initially joined the program to fulfill her community service hours for her bachelor’s degree in business administration, she continues volunteering because of her passion for helping others.

“I just fell in love with VITA and helping people,” Cook said. “You get people from all different backgrounds coming to VITA to prepare their taxes. Some people can’t read, so I help them with the questions and make them feel comfortable because I would want someone to make me feel comfortable. I help them understand and fill out the paperwork.

“Not a lot of people really understand taxes. They know they have to file taxes and that they may get a refund, but they don’t really understand it. I love helping them to understand; that’s what I’m here for.”

Media Contact: Brittany Magelssen, UT Dallas, 972-883-4357, brittany.hoover@utdallas.edu, or the Office of Media Relations, UT Dallas, (972) 883-2155, newscenter@utdallas.edu.